CAPE TOWN — The persistent electricity deficit across Africa, once viewed primarily through the lens of humanitarian crisis, has emerged as one of the most compelling commercial frontiers for global capital. While nearly 600 million people on the continent live without power, the stark mismatch between soaring demand and chronic under-investment is creating a high-stakes landscape for energy majors and institutional financiers.

According to data from the International Energy Agency (IEA), achieving universal electricity access across the continent requires an annual investment of approximately $180 billion.

Currently, tracked commitments hover below $30 billion per year, leaving a massive capital vacuum. This shortfall exists despite the fact that Africa houses 20% of the world’s population, yet attracts a mere 2% of global clean-energy spending.

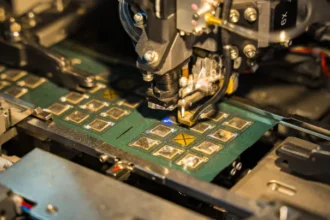

For the private sector, this “supply-demand” imbalance represents a rare certainty in a volatile global market. Rapid urbanization, a burgeoning industrial base, and the rise of energy-intensive sectors like data centers are driving a projected surge in consumption through 2030.

In financial terms, the necessity of power makes it a “bankable” commodity; reliable energy is the prerequisite for the digital and physical infrastructure that generates sustained revenue.

The shift in narrative is already influencing the portfolios of global oil and gas giants. Facing natural depletion in traditional reserves, major producers are pivoting toward African frontier basins to secure future volumes.

Some industry forecasts for 2026 suggest that without aggressive new acquisitions or discoveries, major producers could see output drops of hundreds of thousands of barrels per day within a decade.

The commercial viability of these assets is best illustrated by Mozambique’s $20 billion LNG project. Anchored by tens of trillions of cubic feet of recoverable gas, the development represents one of the largest financing packages ever assembled on the continent. It serves as a blueprint for how domestic industrialization and global export demand can align to provide long-term state revenue.

Furthermore, analysts argue that utilizing Africa’s natural gas resources is a pragmatic path toward ending energy poverty. Proponents suggest these resources can bridge the electricity gap for hundreds of millions of people while contributing only marginally to global emissions—a factor that strengthens the investment case even as the world transitions toward greener energy.

”Energy poverty is not just a challenge – it is Africa’s greatest investment opportunity,” says NJ Ayuk, Executive Chairman of the African Energy Chamber. “What we are witnessing today is a historic convergence of demand, resources and political will. The companies and investors that choose to partner with Africa now will not only generate long-term returns, but help power industries, create jobs and define the next era of global energy.”

As the sector prepares for African Energy Week 2026 in Cape Town, the focus is shifting toward translating this structural demand into “bankable” projects. From gas-to-power initiatives to large-scale renewables, the objective is clear: closing Africa’s energy gap is no longer just a social imperative—it is the defining commercial play of the decade.

Read More: See The Richest People In Africa List by Net Worth Ranking (Forbes)