President Biden said Wednesday he is forgiving up to $10,000 in federal student loan debt for millions of Americans and an additional $10,000 for low-income borrowers while extending a pause on monthly payments, delivering long-awaited relief just weeks before the midterm elections.

Under the plan, borrowers earning less than $125,000 a year, or less than $250,000 a year as a couple, will be eligible for up to $10,000 in loan forgiveness. Recipients of Pell Grants, which are reserved for students with the greatest financial need, are eligible for another $10,000 in relief.

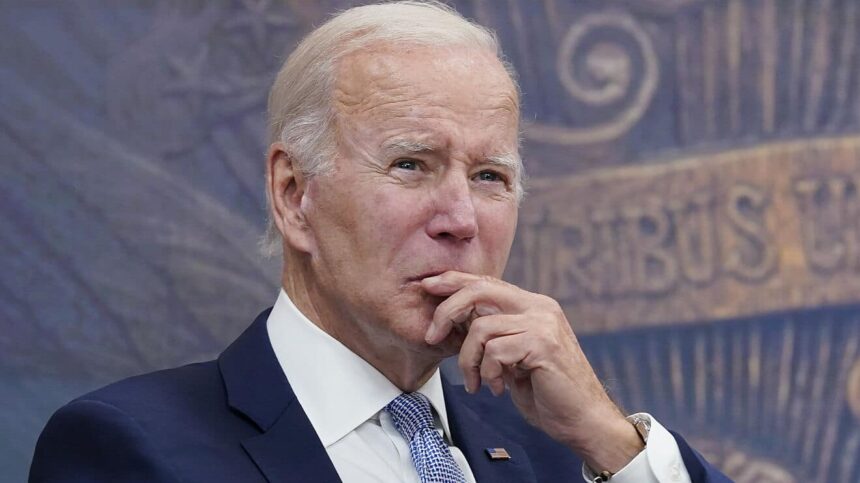

“An entire generation is now saddled with unsustainable debt in exchange for an attempt at least at a college degree,” Mr. Biden said in remarks at the White House. “The burden is so heavy that even if you graduate, you may not have access to the middle-class life that the college degree once provided.”

We're now on WhatsApp. Click here to join.

Current students will be eligible for debt relief as well, although future students will not be, according to senior administration officials who explained the details of the plan on a call with reporters. Undergraduate loan payments will also be capped at 5% of monthly income.

Mr. Biden said roughly 43 million borrowers will benefit from the debt forgiveness portion of his plan. About 60% of those borrowers are Pell Grant recipients and thus eligible for the $20,000 in cancellation, and 90% come from households making less than $75,000 per year. Mr. Biden said nearly 20 million people will have their debt fully canceled.

The president is also deferring student loan repayments until the end of the year, and the Education Department and the president said this will be the last time the pandemic-era pause is extended.

The Education Department said nearly 8 million borrowers will have their debt forgiven automatically, while others will have to apply for relief. The Department of Education will provide a short application for borrowers seeking debt relief in the coming weeks, Mr. Biden said. The Department of Education says borrowers can sign up to be notified when the application is available.

Income caps will be based on either 2020 or 2021 income. If a person or couple’s income was below the cap in either year, they will be eligible, a senior administration official said.

The move to forgive student debt follows months of internal White House deliberations over the feasibility and cost of doing so. Mr. Biden made student loan forgiveness one of his top priorities during his presidential campaign, and Democrats have pushed the administration to deliver on his promise. Republicans have said Mr. Biden does not have the authority to cancel the debt, and his plan is certain to face a barrage of legal challenges.

In anticipation of the court battles to come, the Education Department released a memo from general counsel Lisa Brown with legal justification for Mr. Biden’s actions. Brown cited a 2003 law known as the HEROES Act, which she said gives the education secretary broad authority over student aid programs during a period of national emergency.

“In present circumstances, this authority could be used to effectuate a program of categorical debt cancellation directed at addressing the financial harms caused by the COVID-19 pandemic,” Brown wrote. “The Secretary could waive or modify statutory and regulatory provisions to effectuate a certain amount of cancellation for borrowers who have been financially harmed because of the COVID19 pandemic.”

A Penn Wharton Budget Model analysis concluded that forgiving $10,000 of student loan debt for those earning up to $125,000 a year would cost nearly $300 billion in the first year. It also found more than two-thirds of the debt forgiveness would aid Americans in the top 60% of earners.

Addressing the cost of the plan, Mr. Biden pointed to previous deficit reduction efforts, saying the money exists to pay for the program “many times over.” He said he will “never apologize for helping Americans, working Americans, and the middle class.”

But low-income Americans who never attended college and are struggling financially amid record-high inflation will not benefit from any debt cancellation, critics of student debt cancellation point out. Erasing some student loan debt would also not address the rising cost of college, which has historically outpaced inflation in recent decades.

Senior administration officials on the call with reporters argued that any impact on inflation by nixing student debt would be “largely offset” by the resuming of student loan payments.

The pause on student loan repayment began under the Trump administration at the onset of the pandemic, and Mr. Biden has paused student loan repayments a total of four times since he took office. With interest rates set to zero, the pause has saved federal student loan borrowers more than $1.5 billion each month, according to an April report from the Financial Health Network.