The Ghanaian government has announced the full settlement of US$1.47 billion in energy-sector debt, marking a major turnaround for a power industry that had been teetering under the weight of unpaid obligations and strained investor confidence.

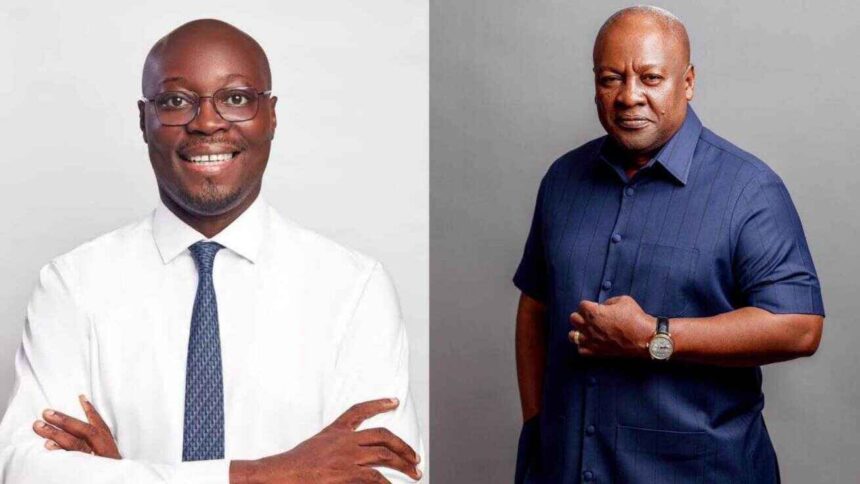

The payments, completed within President John Dramani Mahama’s first year in office, have effectively cleared legacy arrears across gas supply, power generation, and World Bank-backed guarantees — a development officials say restores fiscal stability and international credibility to the sector.

Finance Minister Cassiel Ato Forson confirmed the milestone in a social media post on Monday, January 12, 2025, describing the clearance as a decisive step in resetting Ghana’s energy finances after years of accumulated liabilities.

When the Mahama administration assumed office in January 2025, the power sector was facing severe pressure from unpaid gas supplied from the Offshore Cape Three Points (OCTP) field. The situation had depleted a US$500 million World Bank Partial Risk Guarantee (PRG), a safeguard originally established in 2015 to underpin private investment in the Sankofa Gas Project.

The PRG had been instrumental in attracting nearly US$8 billion in private sector investment, guaranteeing payments to project partners ENI and Vitol in the event of shortfalls. Its exhaustion had raised concerns among lenders and investors about governance and payment discipline in Ghana’s energy sector.

According to the Ministry of Finance, the government has now fully repaid US$597.15 million, inclusive of interest, drawn under the World Bank guarantee as of December 31, 2025, restoring the facility in full. In parallel, all outstanding gas invoices owed to ENI and Vitol — totaling approximately US$480 million — have been settled, bringing Ghana fully up to date on its obligations to the Sankofa partners.

Beyond gas payments, the government has also addressed long-standing liabilities to Independent Power Producers (IPPs). In 2025 alone, approximately US$393 million was paid to clear legacy IPP debts, following the renegotiation of power purchase agreements to secure better value for money for the state.

Major beneficiaries of the IPP settlements included Karpowership Ghana, Cenpower, Sunon Asogli, Amandi Energy, and several others, with individual payments ranging from over US$120 million to smaller outstanding balances.

See below a detailed breakdown of payments to each IPP.

- Karpowership Ghana Co. Ltd – US$120,000,000

- Cenpower Generation Co. Ltd – US$59,444,180

- Twin City Energy (Amandi) – US$37,986,534

- Early Power ltd – US$42,000,000

- BXC Company Ltd – US$10,560,000

- Meinergy Technology – US$8,820,000

- Sunon Asogli Ghana Ltd – US$54,000,000

- AKSA Energy Limited – US$30,000,000

- Cenit Energy ltd – US$30,000,000

TOTAL – US$392,810,714

Officials say the debt clearance has been complemented by stricter enforcement of the Cash Waterfall Mechanism, improved budgetary provisions, and renewed engagement with upstream partners such as Tullow Oil and the Jubilee Field operators.

These measures are aimed at ensuring reliable electricity generation, boosting domestic gas production, and reducing dependence on costly liquid fuels.

The government has assured industry stakeholders and international partners that the reforms mark the end of unchecked energy debt accumulation, signaling a more disciplined approach to managing Ghana’s power sector finances going forward.