- Japan’s exports rose 4.2% in September despite U.S. tariffs.

- Exports to Asia jumped 9.2%, while U.S. shipments fell 13.3%.

- Auto exports to the U.S. dropped 24.2%, led by declines at major automakers.

- Imports grew 3.3%, including 9.8% more from China.

- Trump’s 15% tariff policy and Japan’s $550 billion U.S. investment pledge remain under review.

Japan’s export sector posted a surprising rebound in September, defying the impact of U.S. tariffs imposed by President Donald Trump. Government data released Wednesday showed exports rose 4.2% from a year earlier, powered by solid demand from Asia that offset a steep drop in shipments to the United States.

The latest trade data from the Ministry of Finance revealed that exports to Asia surged 9.2%, driven largely by China’s 5.8% increase in purchases from Japan. In contrast, exports to the U.S. plunged 13.3%, marking the sixth consecutive monthly decline as tariffs continued to weigh on American-bound goods.

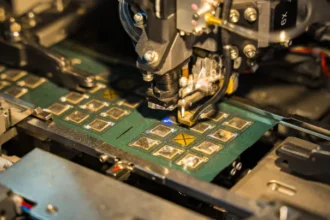

Automobile exports — a cornerstone of Japan’s economy — were hit hardest, with shipments to the U.S. plummeting 24.2% in September. Industry leaders such as Toyota Motor Corp. have faced mounting pressure as trade tensions persist under Washington’s protectionist measures.

Meanwhile, imports rose 3.3%, reflecting Japan’s steady domestic demand and higher import volumes from neighboring Asian nations, including a 9.8% rise in imports from China.

The trade results come just a day after Sanae Takaichi was confirmed as Japan’s new prime minister, making history as the nation’s first female leader. Known for her conservative stance and support for increased government spending, Takaichi has pledged to boost wages, expand fiscal stimulus, and maintain loose monetary policy — a combination likely to keep the yen weak and strengthen the competitiveness of Japanese exports.

“A weaker yen benefits exporters by increasing the value of overseas earnings when converted back into local currency,” analysts noted, adding that the trend could support further export growth if global demand holds steady.

Takaichi faces a tough political path ahead, as her Liberal Democratic Party (LDP) and coalition partners lack a parliamentary majority. Internal divisions may also complicate her ability to deliver on ambitious economic reforms.

Also Read: China’s Exports to U.S. Plunge 27% in September as Global Shipments Surge to Six-Month High

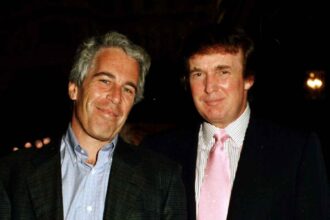

Trump, who is expected to visit Japan later this month to meet with Takaichi, announced a new trade framework in July that introduced a 15% tariff on Japanese goods — down from a previously threatened 25%. In return, Japan pledged to invest $550 billion in the U.S. and open its domestic markets further to American automobiles and rice exports.

The coming meeting between Trump and Takaichi will be closely watched by investors and global trade analysts, as both nations navigate shifting alliances and economic uncertainty in the global supply chain and foreign exchange markets.