The government is eliminating taxes on sanitary pads made in the country, according to a statement made by Finance Minister Ken Ofori-Atta.

He said that in order to lessen Ghanaians’ financial hardships, the New Patriotic Party (NPP) administration is implementing these fiscal measures.

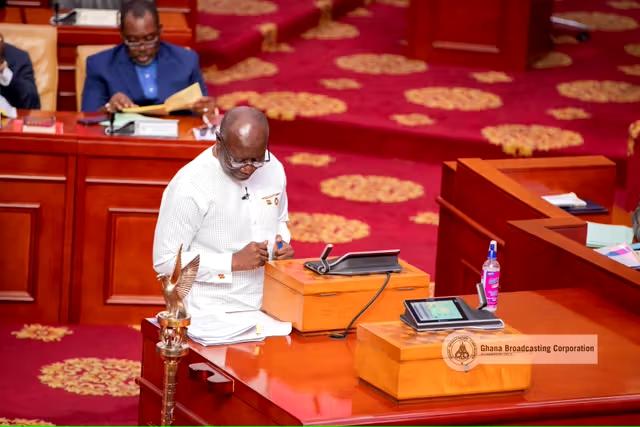

Mr. Ofori-Atta stated the following while introducing the 2024 Budget and Economic Statement to the Parliament in Accra:

We're now on WhatsApp. Click here to join.

In addition, Mr. Speaker, the following reliefs have been given priority for execution:

i. Continue to apply the zero percent VAT rate to locally produced African prints for an additional two years;

ii. Eliminate import taxes for eight years on the import of electric cars used for commuting;

iii. Eliminate import taxes for eight years on electric vehicles imported by Ghanaian registered EV assembly companies that are partially or fully knocked down;

iv. Continue the two-year zero percent VAT period for locally assembled automobiles;

v. Locally made sanitary pads are subject to zero rate VAT

vi. Exempt import duties on raw materials used in the domestic production of sanitary pads;

vii. Exempt medical consumables, pharmaceutical raw materials, and agricultural machinery, equipment, and inputs from import duties;

viii. To streamline administration, a flat VAT rate of 5 percent will be implemented for all commercial properties, replacing the current standard VAT rate of 15 percent.

Furthermore, Ofori-Atta revealed that, for the same eight-year period, import duties would not apply to fully or partially knocked down electric vehicles imported into the nation by registered EV assembly companies.

![Shatta Wale - Designer Lyrics 3 Shatta Wale - Designer [Stream/Download MP3] and song Lyrics on Townflex](https://townflex.com/wp-content/uploads/2023/11/Designer-Wale-min.jpg)