- SpaceX to buy EchoStar’s spectrum licenses in a $17 billion deal.

- Boost Mobile subscribers to gain direct-to-cell satellite access.

- Starlink aims to boost mobile network capacity by 100 times.

- SpaceX has launched over 8,000 Starlink satellites since 2020.

- FCC says deal could supercharge competition in U.S. telecom.

SpaceX has struck a $17 billion agreement with EchoStar to acquire wireless spectrum licenses, a move set to supercharge its Starlink satellite network and expand its ambitions in next-generation 5G connectivity.

The deal, announced Monday, will also see Boost Mobile subscribers gain access to Starlink’s direct-to-cell service, extending satellite-powered mobile coverage to regions with little or no service.

The acquisition provides SpaceX with exclusive spectrum rights to deploy upgraded, laser-connected satellites, designed to expand network capacity by “more than 100 times.”

Gwynne Shotwell, president and COO of SpaceX, said the deal will help the company “end mobile dead zones around the world … With exclusive spectrum, SpaceX will develop next-generation Starlink Direct to Cell satellites, which will have a step change in performance and enable us to enhance coverage for customers wherever they are in the world.”

The move comes at a time of skyrocketing mobile usage. According to the Cellular Telecommunications Industry Association (CTIA), Americans consumed a record 132 trillion megabytes of mobile data in 2024 — a 35% surge over the previous year.

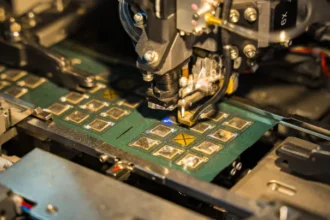

Since 2020, SpaceX has launched more than 8,000 Starlink satellites, creating a global low-Earth orbit constellation that serves militaries, transportation companies, and rural consumers. Nearly 600 satellites dedicated to direct-to-cell service have been launched in 2024 alone, orbiting closer to Earth to enhance coverage.

Critical to deploying these larger satellites is Starship, SpaceX’s giant next-generation rocket. After a decade in development and several complex test flights, Starship is expected to carry out its first operational Starlink missions as early as next year.

The agreement comes just months after the Federal Communications Commission (FCC) raised concerns about EchoStar’s use of mobile-satellite service spectrum. The FCC had questioned whether EchoStar was meeting its obligations to deploy 5G networks in the U.S.

EchoStar, which previously sold spectrum to AT&T for $23 billion, says the SpaceX deal will resolve the regulator’s inquiries. An FCC spokesperson welcomed the move, stating the “deals that EchoStar reached with AT&T and Starlink hold the potential to supercharge competition, extend innovative new services to millions of Americans, and boost US leadership in next-gen connectivity.”

The deal will see SpaceX pay up to $8.5 billion in cash and issue another $8.5 billion in stock, while also covering nearly $2 billion in EchoStar’s debt obligations through 2027.

Following the announcement, EchoStar shares jumped 14.7%, while U.S. wireless carriers including AT&T, Verizon, and T-Mobile all saw stock declines.

After the sale, EchoStar will continue operating its Dish TV, Sling streaming service, Hughesnet internet, and Boost Mobile brand.

For SpaceX, however, the EchoStar acquisition represents a transformative step — allowing the company to operate Starlink’s direct-to-cell services on its own frequencies rather than relying exclusively on leases from mobile carriers like T-Mobile.

As SpaceX continues its push, the battle for global satellite internet dominance is intensifying, with telecom giants and tech firms investing heavily to capture the future of mobile and broadband connectivity.