It is unfortunate that such incidents are occurring frequently in Nigeria, where borrowing money from mobile apps is becoming more popular.

Many people in the country are unable to secure loans from traditional banks due to the high-interest rates and stringent requirements.

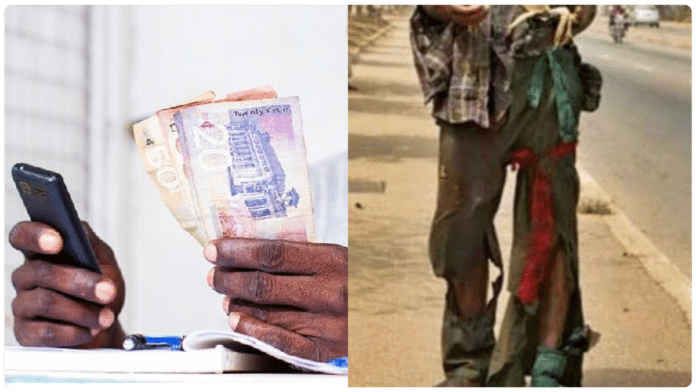

As a result, loan apps have become a popular alternative for people looking to borrow money quickly and with minimal requirements.

However, many of these apps have been accused of charging exorbitant interest rates and using aggressive tactics to collect payments from borrowers.

We're now on WhatsApp. Click here to join.

This incident is a reminder of the dangers of borrowing money without proper planning and due diligence.

It is essential to consider the risks and consequences before taking out a loan, especially from unregulated lenders.

Moreover, it is crucial to read the terms and conditions carefully before borrowing from any loan app, as some may have hidden charges and penalties that could be detrimental to the borrower’s financial health.

In conclusion, the story of the Nigerian man who went mad after failing to repay a loan from a mobile app is a cautionary tale for anyone considering borrowing money from such platforms.

While loan apps may provide quick access to cash, they come with risks that should not be ignored.

It is always wise to explore other options and carefully consider the terms and conditions before taking out a loan.