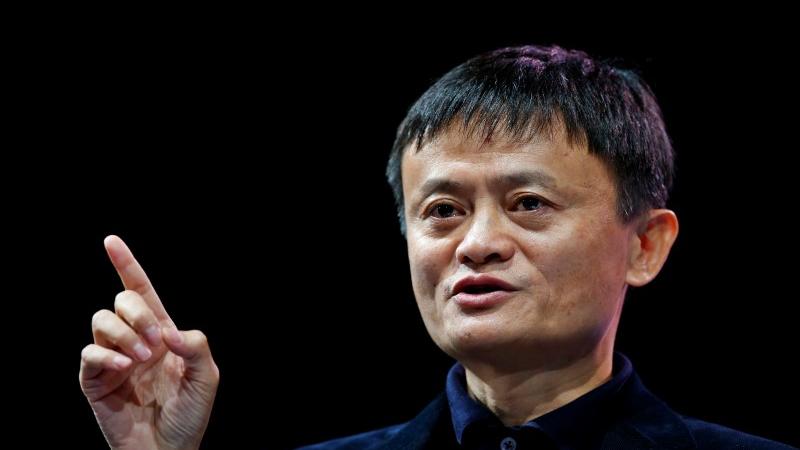

According to a statement issued by the fintech behemoth on Saturday, Ant Group’s shareholders decided to change the shareholding structure, so Chinese billionaire Jack Ma will no longer be in charge.

According to the statement and calculations by CNN, Ma’s voting rights will decrease to 6.2% after the adjustment.

According to its IPO prospectus submitted to stock exchanges in 2020, Ma had 50.52% of the voting powers at Ant through Hangzhou Yunbo and two other firms before the restructuring.

We're now on WhatsApp. Click here to join.

In the statement, Ant further stated that there will be no change to any shareholder’s economic interests as a result of the voting rights adjustment, which is a step to make the company’s shareholder structure “more transparent and diversified.”

No shareholder would have “sole or joint control over Ant Group,” according to Ant, which stated that its 10 largest shareholders, including Ma, had resolved to no longer act together when exercising their voting rights and would instead only vote independently.

After Chinese regulators canceled Ant’s $37 billion IPO in November 2020 and demanded that the company alter its operations, the voting rights reform followed.

Ant submitted a request to increase its registered capital from $1.2 billion to $2.7 billion as part of the company’s restructuring.

According to a government announcement published late last week, the application was recently granted by the China Banking and Insurance Regulatory Commission.

After the fundraising campaign, Ant will own 50% of its important consumer finance division, and a company under the jurisdiction of the Hangzhou municipal government will own the remaining 10%.

Conclusion

Stay tuned for more interesting news updates.

Follow Townflex On TikTok

READ ALSO: Greg Roman’s Net Worth: How Much Money Is Greg Roman Worth?